Click the above link to go to the relevant section.

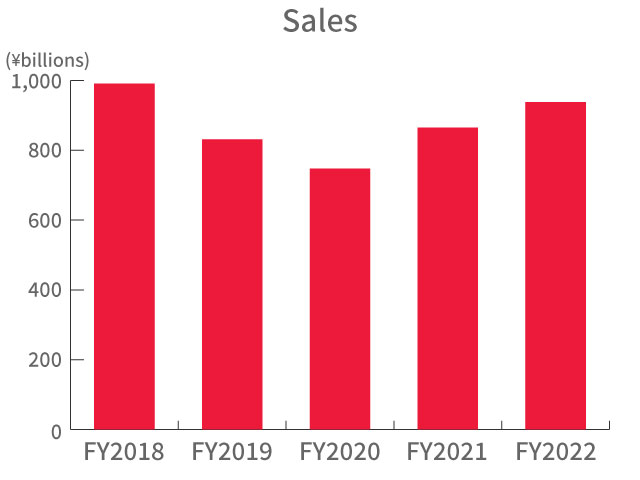

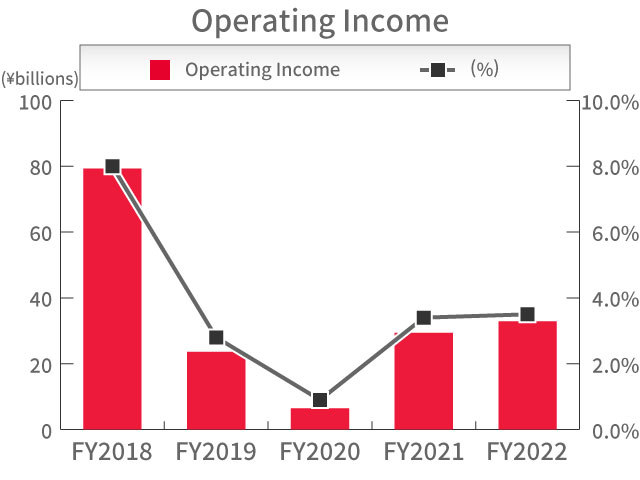

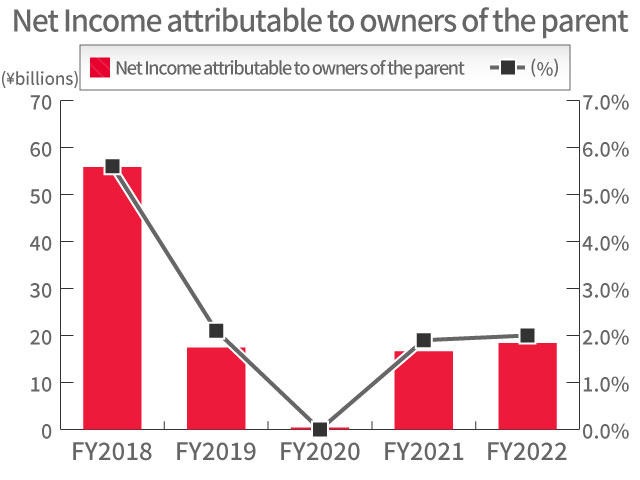

Business Trend

Breakdown by Business Segment

* Part of automotive business operations were transferred to the industrial machinery business. Accordingly, figures for FY2019 have been reclassified to match current segments.

* Part of the others business segment was transferred to the industrial machinery business. Accordingly, figures for FY2021 have been reclassified to match current segments.

Breakdown by Region

Sales by Customer Location

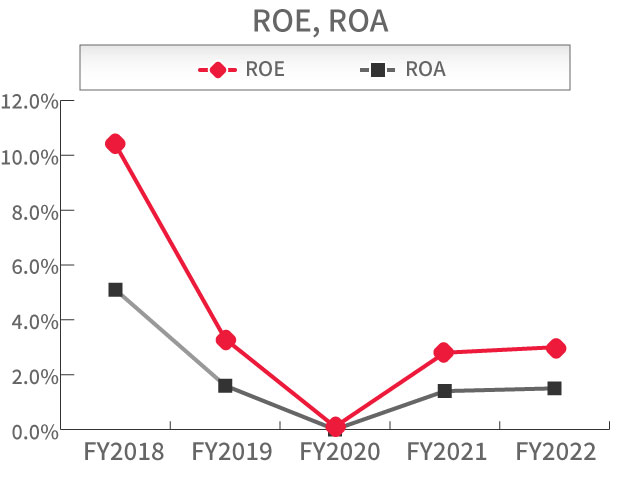

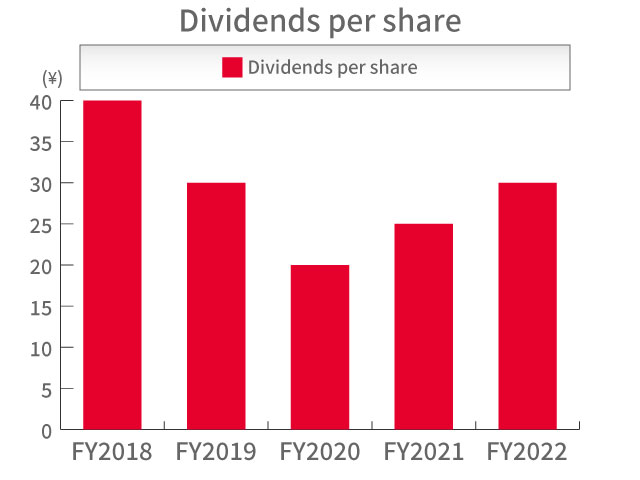

ROE / ROA / Dividends / Total return ratio

* Total return ratio = (Dividends paid + Amount of share repurchased) ÷ Net income

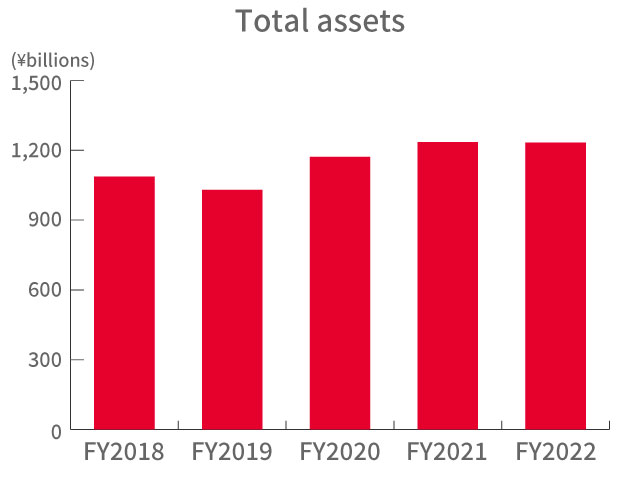

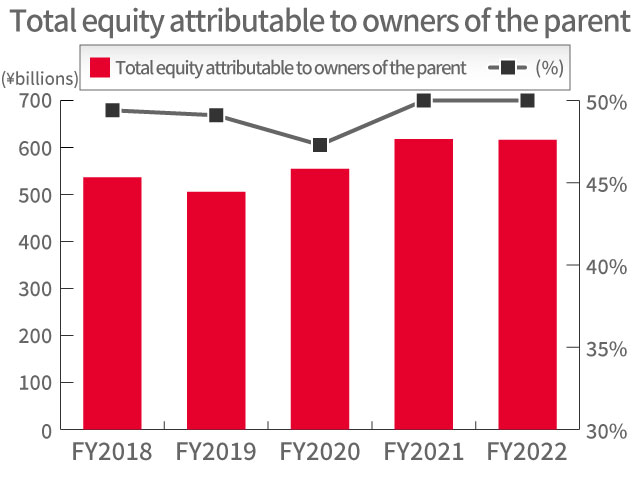

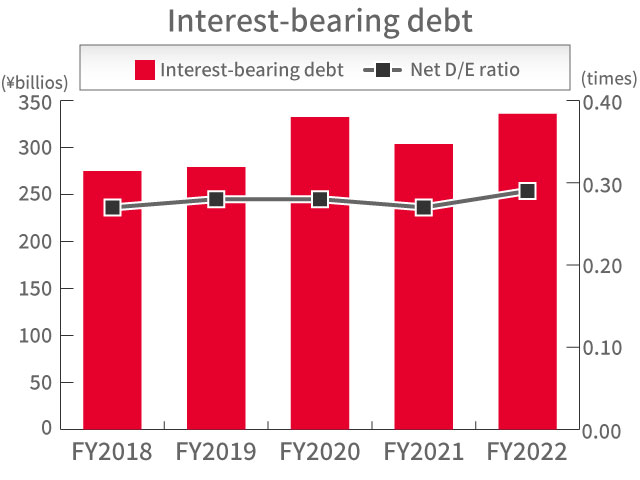

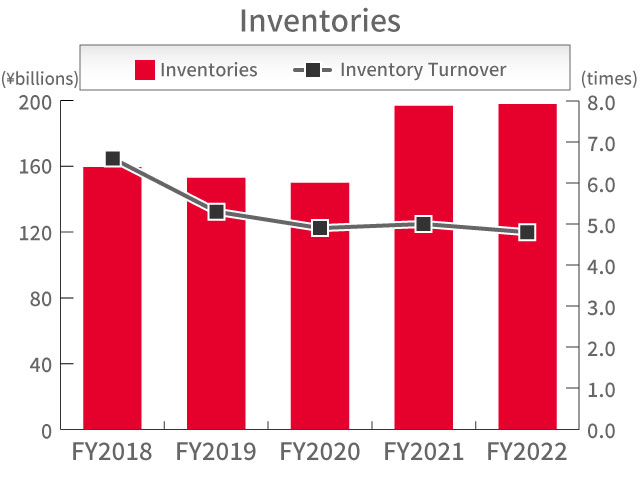

Assets / Equity / Debts / Inventories

* In the fiscal year ended March 31, 2022, NSK finalized the provisional accounting treatment for business combination. The consolidated financial statements for the year ended March 2021 reflect the revision of the initially allocated amounts of acquisition price.

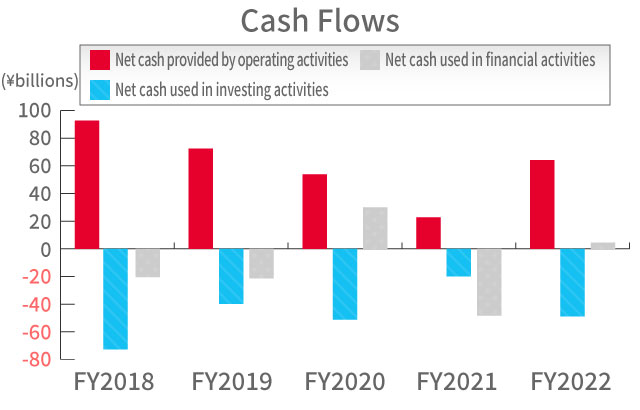

Cash Flows

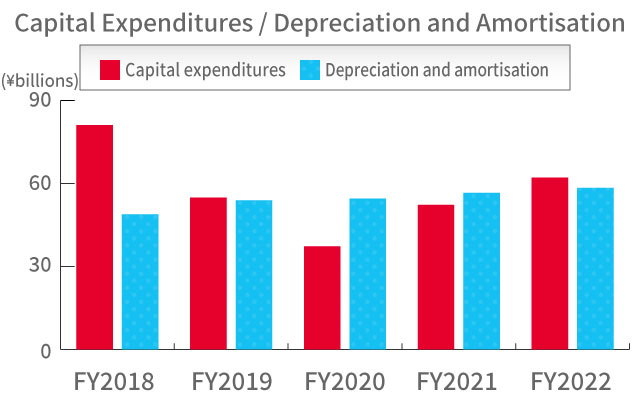

Capital Expenditures / Depreciation and Amortisation

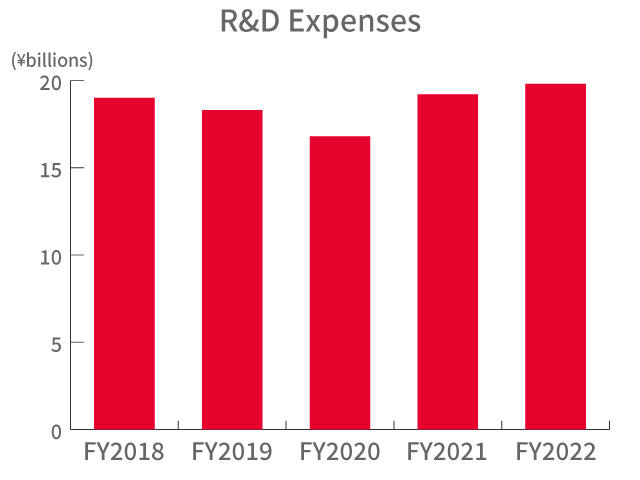

R&D Expenses